Automating the three-way match means that transactions that need additional review are pinpointed immediately. The best way to manage your GRNI account is by leveraging https://online-accounting.net/ automated procure-to-pay software like Planergy. This issue can happen multiple times when using a manual AP system, with the GRNI account continuing to grow.

- Auditors and accountants are likely to pay attention to overstated GRNI balances to figure out why invoices have not been received.

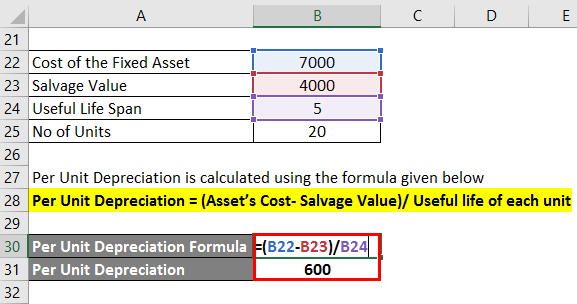

- The ending result is a debit to Stock and a credit to Payables, the regular AP accounting flow.

- GRNI is a financial concept that refers to a situation where goods have been received by a company but have not yet been invoiced by the supplier.

- Upon delivery, the customer issues three delivery note copies to the department requesting the supplies, retains a copy for the finance department, and hands one over to the supplier.

These goods should still be recognized as an expense in the period they were received, even though the invoice has not yet been received. This is because the company has already received the goods and will eventually have to pay for them. Once the supplier sends an invoice for the goods, the company can then update its accounts payable ledger to reflect the invoice amount https://adprun.net/ and pay the supplier accordingly. Accrued expenses are important because they represent a liability that the company owes in the future. When a company incurs an expense but has not yet paid for it, it is essentially borrowing money from the vendor. This means that the company will need to pay for the goods or services at a later date, which will affect its cash flow.

How to Record a Journal Entry for a Sale on an Account

Therefore, we put an accrual in place which allows us to recognise the expense and also the eventual liability on the balance sheet which will become a trade creditor when the invoice comes in. When the invoice is received from the supplier, the liability can be transferred from the goods invoiced not received account to the accounts payable account of the supplier using a second journal entry. Accruals refer to expenses or revenues that have been recognized but not yet paid or received, while deferrals refer to expenses or revenues that have been paid or received but are not yet recognized. These concepts are important for companies to accurately reflect their financial position and performance. They are recorded in the company’s balance sheet as a liability, which reduces the company’s equity.

- The absolute correct answer for this IN THEORY is that you should do nothing.

- This refers to goods that have been received by a company but have not yet been invoiced by the supplier.

- For the transactions for which no differences exist, you

can accept the reconciliation data.

If you plan to get paid in the future for products and services you sell, you can send your customers an invoice. Automation removes the human element, improving accuracy while freeing your staff to dedicate their time and talents to higher value tasks. Time that might’ve been spent double-checking vendor data or correcting mistakes can instead be used for innovation and strategic planning. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. If no standard report exists, which tables-fields to look at for an abap program.

Trial Balance

Before you post the correction transactions, you can

examine the effect of the correction transactions. In the Checklist Reconciliation Goods Received Not Invoiced (tfgld4495m200) session,

select the Print Not Final Reconciliation Corrections check box. Check whether a difference is printed on the report, or compare the report with

the trial balance. You can use the Operations Management – Financial Reconciliation (tfgld4595m000) session to

examine the reconciliation data.

Since accrued liabilities represent obligations that a company owes but has not yet paid, it is critical to manage them effectively. By accurately identifying and tracking these obligations, a company can better forecast its cash flow needs and avoid payment delays or penalties. As a practical matter, doing this with every single prepaid expense and purchase can bog down your accounting with tracking way too many prepaid items, particularly services. To avoid this, set a minimum threshold for entering an item in the prepaid expense account.

What information is required in the goods received note?

At other times, it may generate and send the invoice before delivering the goods or services. But, to do so, it’s necessary to match and, if required, revalue the transactions entered at different times. Leveraging artificial intelligence, procurement software is able to generate accurate GRNI reports on time, eliminating human error, saving time and expenditure. In most transactions, the invoice is to arrive before a 3-way match is complete, so most transactions do appear on the GRNI every now and then.

What Are Prepaid Expenses/Prepaid Revenues & How Are They Reported on the Balance Sheet?

GRNI can also impact a company’s cash flow, as it represents a liability that needs to be paid at some point. If the company has a large GRNI balance, it may need to allocate additional resources to pay off these liabilities in a timely manner. Use the Print Trial Balance (tfgld3402m000) session to reprint the trial balance for the

integration ledger accounts of which you rebuilt the history. Use the Print Reconciliation data (tfgld4495m000) session to regenerate the

reconciliation report based on the rebuilt ledger accounts. Your GRNI account may end up with hundreds of entries involving multiple purchases, multiple items and multiple vendors. Tracking and updating them when you receive the invoices takes increasing time and effort and it’s easy to lose track.

Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing.

Business is Our Business

Goods received note helps customers and suppliers make and keep a binding agreement, and empowers organizations to keep stock of inventory levels. Let’s say after the supplies are delivered, the department https://simple-accounting.org/ within the requesting organization realizes some issue they didn’t point out at first. Now, a closer look at the goods received note shows that functionality was tested and worked flawlessly.